Founder Diligence: Evaluating Behaviors for Early-Stage Startups

In early-stage startups, founder behavior isn’t just one of many factors — it can be the dominant variable (and often is) in determining whether a company endures and thrives, or, plateaus and dies. I’ve worked with countless founders and categorized functional behaviors and dysfunctional behaviors for startup-company building. This post serves to illuminate them, show you a simple rubric for evaluating them, and ways to mitigate. Again, this is not to judge whether a founder is good/bad, right/wrong, ethical/unethical — this is purely to assess behaviors that enrich company value and those that do not. This list is also not exhaustive.

The Problem: Behavioral Risk Is Hidden, Compound Dilution

Technical diligence and market analysis are visible and tracked. Behavioral risk is the silent multiplier on burn and dilution. It shows up in ways the spreadsheet can’t capture: slowing decision-making, team churn, distortions of truth, boundless optimism that masks realism, or a founder who looks great in the boardroom but crumbles under pressure.

Empirical data backs this up:

According to Noam Wasserman’s research, about 65% of high-potential startups fail due to co-founder conflict. Entrepreneur+2the failure report+2

Founders’ personality traits significantly correlate with firm success. A global sample found distinct “successful-founder” personality types (e.g., openness to novelty, higher activity levels) that doubled the odds of success (Cornell University, arXiv).

While the top reason often cited is “no market need” (~42 %) in the CB Insights failure study, team/management issues (23 %) show up high on the list too.

What this tells us: The most influential “human entity” inside the company (founder, core team dynamics) is a major predictor of failure risk.

Functional vs. Dysfunctional Founder Patterns

Before we go into our decision matrix, it’s helpful to see what we’re aiming for (and what to avoid). These aren’t to be seen as black and white— that you want someone who is always functional. But you do want them high on the functional spectrum.

Functional behavioral patterns (what great founders tend to exhibit):

Consistent Ownership Under Pressure – Not just when things are smooth, but when nothing seems to be working and the burn rate is higher than expected. The point of power is always with them and in the present moment — this helps them triumph over the present challenge.

Positive-Sum Thinking – They look to create value for stakeholders (team, investor, customer) rather than win at the expense of someone else. Is their instinct to find new ways to wow their clients, or, find short-term underhanded ways to extract value through predatory pricing, for example.

Behavioral Congruence – What they say, what they believe, and what they do align — especially under stress. Do they actually value feedback? Or do they get defensive, angry, and dismissive when difficult feedback is delivered?

Transparent Communication – They bring bad news, propose a path forward, and keep the team in step. News is often taken as just that— data and feedback. This is in comparison to taking things personal (good news = I am good, bad news = I am bad).

Dysfunctional patterns (early warning signals):

Ego & Status Over Impact – Decisions are overly-optimized for optics (“how it looks”) rather than deliverables (“what we measurably achieved”). Their vision is often not backed by concrete, sound examples.

Zero Inconvenience Accountability – Blames external forces (“the market,” “the team,” “the investor”) without internal reflection or solution-orientation. Generally afraid or resistance to run towards truth and hard answers.

Charm-to-Enemy Flip – Initially charismatic (honey-moon phase), but under pressure becomes defensive, secretive, or combative (you become the enemy). All functional relationships require navigating highs and lows of life with respect.

Reality Fragmentation – Different parts of the team or company see different stories; the founder’s narrative shifts to fit new circumstances. We all need reality to be malleable — but if reality is too malleable (delusional) we don’t have a stable place from which to build.

Risk Under Pressure: It’s Not About Perfection

One dimension worth adding: resilience under stress. It’s unrealistic to expect flawless behaviour — any founder will make mistakes. The test is consistency under pressure.

The stressful phases (pivot, burn-rate spike, board friction, key hire departure) reveal operating system behaviour, not the polished stage of a first meeting.

A founder who handles good times well but cracks when things get hard is a high-risk bet.

Behavioral risk is amplified when the founder has only experienced smooth sailing (market tailwinds, for example). Stress is the crucible. Most startups will build through numerous economic cycles— you don’t want them to crumble under the troughs or become unrealistic at the peaks.

In other words: We’re not asking for perfection — we’re asking for demonstrated consistency of functional behavior under pressure.

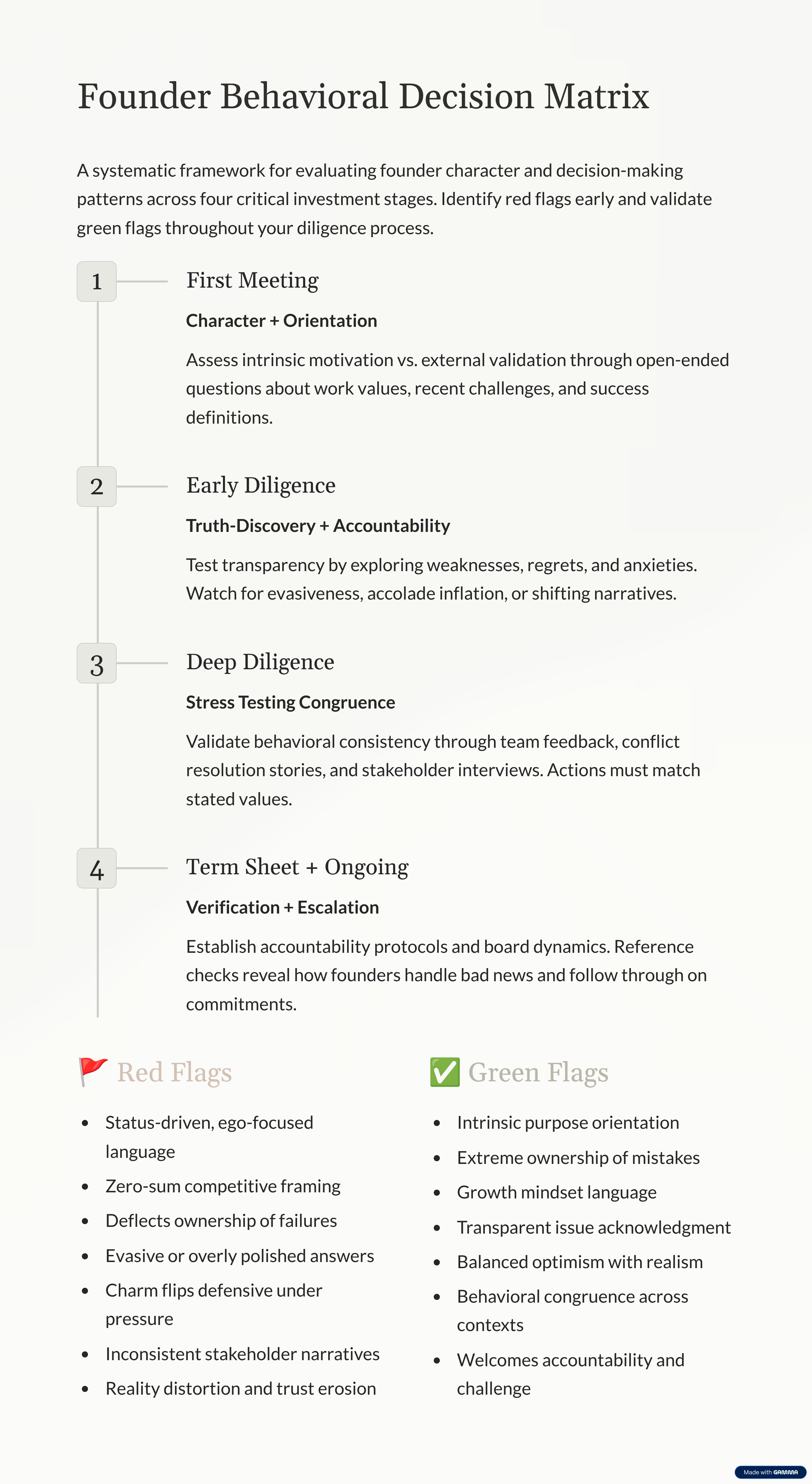

A Practical Decision Matrix for Founder Behavior

Here is the stage-based decision matrix updated with the stress-resilience dimension and anchored by empirical data.

Stage 1: First Meeting (Character + Orientation)

Instrument / Questions:

“What’s important to you about your work?”

“Tell me about a recent challenge that didn’t go your way.”

“How do you define success?”

What to listen for (stress proxy):

Do they refer to past setbacks or only smooth wins?

Do they frame success in external terms (status, exit) or intrinsic terms (impact, learning)?

Does their physiology light up about their significance, or, about delighting customers?

Red Flags:

Status-driven answers (“we’ll crush competitors,” “exit in 24 months”, “we will be iconic”).

Zero-sum language and thinking (“if they win, we lose”).

Deflection of responsibility (“the market wasn’t ready,” “our team didn’t deliver”).

Green Flags:

Purpose oriented (“we’re here because…”).

Ownership (“I could’ve done X better,” “we missed this signal”).

Growth mindset (“we’re learning fast…”).

Stage 2: Early Diligence (Truth Discovery + Accountability)

Instrument / Questions:

“What are your company’s biggest weaknesses or blind spots?”

“Walk me through a decision you regret.”

“What keeps you up at night?”

Stress proxy: The founder’s willingness to unpack imperfections now, before the term sheet.

Red Flags:

Evasive (politician responses) or overly polished answers (too rehearsed) — you want charm but charm is not the only thing you need for alpha.

Over-emphasis on wins, minimization of issues. This is typically a sign that they are afraid of bad news or difficult truths.

Stories shift across meetings (“that issue isn’t relevant anymore”) — this is a sign of chronic misrepresentation + incongruence.

Green Flags:

Transparent acknowledgment of issues (and context) and what they are doing about it. Also, a willingness to “not know” and be curious to find the answer.

Combined optimism + realism—sees the big vision and knows where they need to focus in the near-term.

Traces self-accountability under pressure. They often look for what they missed and what they can do instead … versus explaining responsibility away or placing blame on others.

Stage 3: Deep Diligence (Stress-Testing Congruence)

Instrument / Questions:

“What would your team say are your biggest strengths and weaknesses?”

“How do you handle feedback when someone disagrees?” (better yet — just disagree with them on something fundamental to the business)

“Tell me about a time you lost a key person or deal — how did you respond?”

Stress proxy: Behaviour in real scenarios of breakdown, conflict, churn.

Red Flags:

Charm turns defensive when challenged.

Team narratives diverge.

Foundational blame-shifting (“investors didn’t get it”).

Green Flags:

Consistent stories across founder + team.

Behaviour reflects stated values.

Positive-sum framing of tough times (“we looked for mutual wins”).

Stage 4: Term Sheet + Ongoing Relationship (Verification + Escalation)

Instrument / Questions:

“If we were on your board, how would you want us to challenge you?”

“How do you make sure commitments get followed through?”

Reference check:

“How do they handle bad news?”

“Tell me what it was like working together during really tough times…”

Stress proxy: How the founder handles accountability and escalation when stakes are higher.

Red Flags:

Reality-bending (“that’s not what happened”), lack of audit trail.

Defensive posture, stone-walling on follow-through.

No clear structure for challenge or accountability.

Green Flags:

Founder welcomes challenge, cross-check, transparency.

Formal tracking of commitments.

Partnership mindset: “We work as a team, not a monologue.”

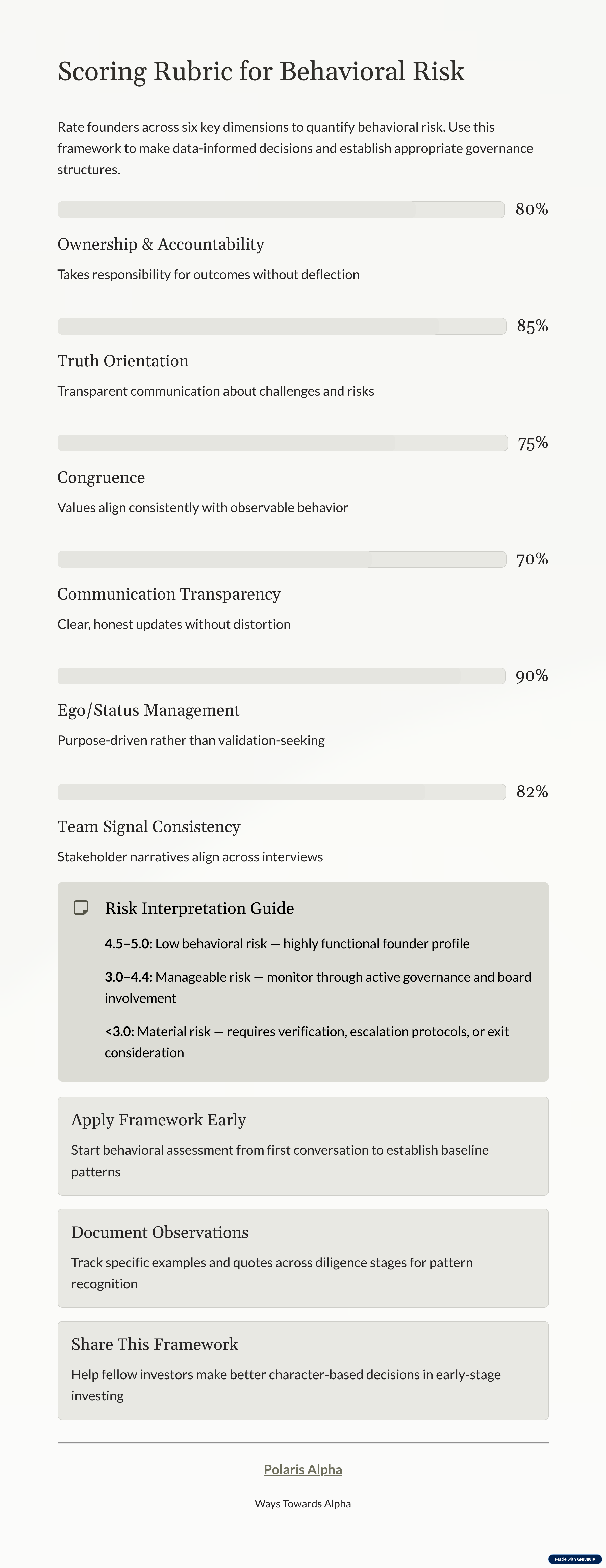

Scoring Rubric: Measure Behavioral Risk

Dimension — Score (1–5)

Ownership & Accountability

Truth Orientation

Congruence (Values ↔ Behavior)

Communication Transparency

Ego/Status

Management Team

Signal Consistency

Overall Behavioral Risk (avg) 4.5–5.0 = Low risk, 3.0–4.4 = Manageable, <3.0 = Material risk

In practice:

A founder scoring consistently above ~4.5 across dimensions is in the “derisked” category — high autonomy, less required governance.

A founder in the ~3–4.4 range can still be a strong bet — but plan for structured governance, documented commitments, clear escalation channels.

Below ~3 means either you’re taking a special-play risk (with commensurate discount/founder governance) or you walk away.

De-risking Strategies You Can Apply Immediately

Cross-Reference Claims — Triangulate founder statements across team, references, advisors.

Document Commitments — Build a written audit trail of promises, actions, and follow-through.

Test Accountability Under Pressure — Trigger scenarios (e.g., board meeting where bad news is shared) and see how founder handles it.

Monitor Team Retention Signal — Dysfunctional behavior often reveals itself through key people departure.

Set Escalation Thresholds — Define clear behavioural boundaries (e.g., threshold for repeating missed commitments) and plan exit or governance triggers.

Look for stress history — Has the founder navigated a pivot, market crash, team turmoil before? Past stress resilience is a must.

The Takeaway: Trust Your Pattern Recognition

Behavioral patterns are the strongest predictors of founder performance under pressure. Waiting for “proof” often means you’re already too late. The earlier you detect distortion, the faster you can either intervene or walk away. And when you find a founder who consistently demonstrates functional behavior under stress, across dimensions, you win the compounding bet.